Is Group Reporting a “Reporting” Tool?

SAP has introduced an intriguing name for its long-standing consolidation engine application: “Group Reporting” (GR). This tool represents the culmination of several evolutionary cycles from its predecessors, including ECCS, SEM-BCS, and BPC. GR incorporates various functionalities, with its core capabilities established decades ago. Notable advancements include seamless integration with S/4 HANA, facilitating shared Master Data and Transactional Data among connected modules. Additionally, the implementation of Fiori reports, which are web-based, along with integration with SAC Analytics and Planning, are noteworthy updates.

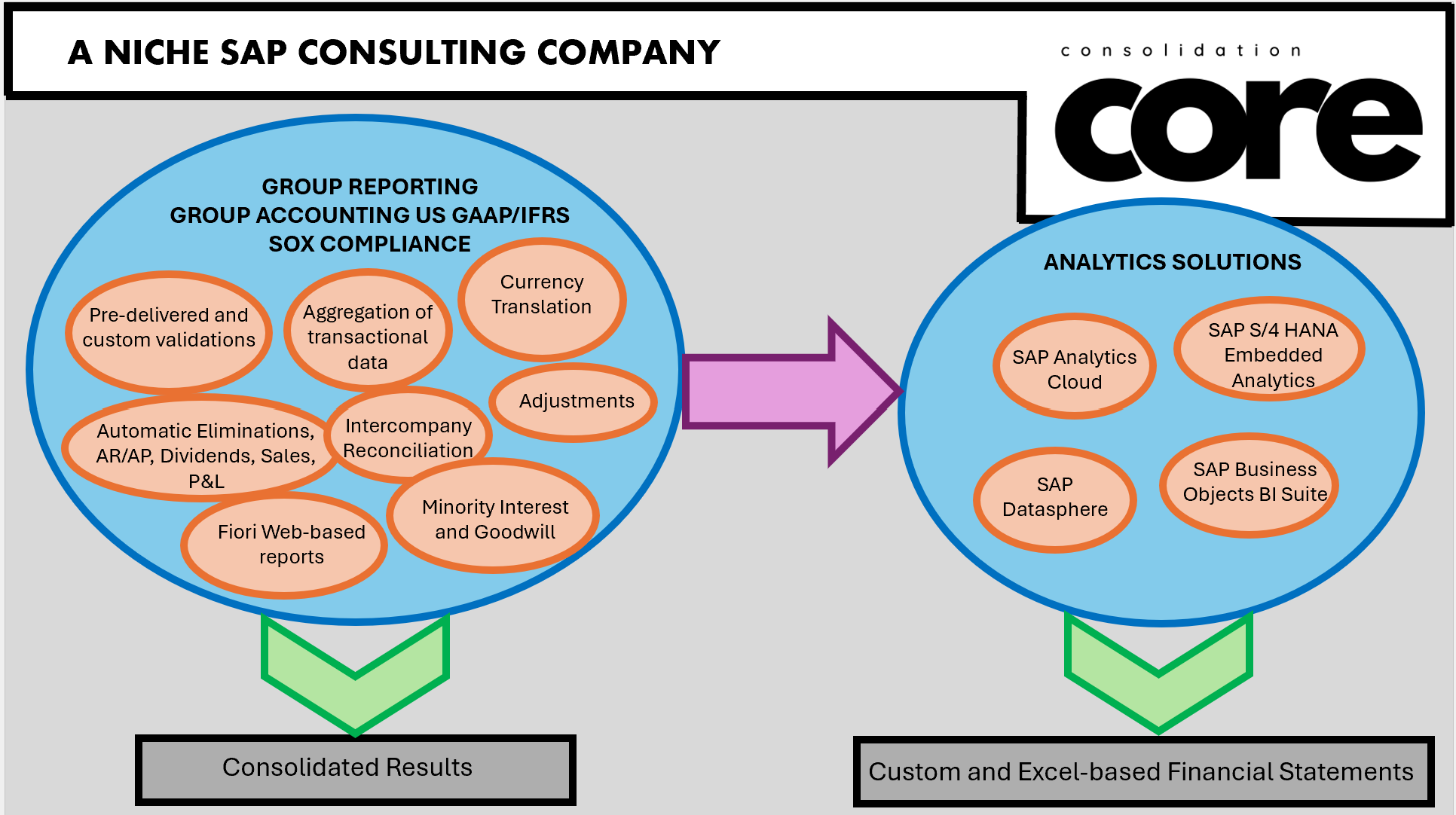

So, how do we address whether GR is a reporting tool? The answer is nuanced. GR’s primary mission is to enable, streamline, and automate the monthly corporate close process, ensuring compliance with US GAAP or IFRS. It addresses complexities such as special currency translation for equity and movements for the Cash Flow statement and automates eliminations for AR/AP, Sales, Dividends, and P&L.

A key feature is the automatic consolidation of investments, which allows the system to manage complex ownership structures, calculating minority interest and goodwill. This is especially valuable in industries characterized by dynamic mergers, ownership restructuring, acquisitions, and divestitures, such as Financial Services, Insurance, Technology, Energy, Utilities, Media, and Telecommunications. Automatic calculations enhance data control and integrity significantly.

Other notable features include the Intercompany Matching and Reconciliation Tool (ICMR), enabling real-time reconciliation of AR/AP transactions, and custom validations that focus on data integrity and quality specific to each organization.

It also enables consolidation by profit center, treating each profit center as an individual unit. This approach facilitates segment reporting, which is essential for Financial Planning and Analysis (FP&A). Consolidated actuals by segment serve as the critical starting point for each forecast cycle.

Following the execution of tasks in the Data and Consolidation Monitor—which streamline, translate, unify, validate, and eliminate data—users should ideally obtain perfectly consolidated financial statements, such as the consolidated Balance Sheet and P&L. However, challenges arise with the “out-of-box” reports provided by the Web-based Fiori apps. These reports often require customization to align with the client’s Master Data and suffer from limited formatting options, leading clients to export data to Excel for final adjustments.

While SAP offers Analytics solutions that complement GR’s consolidated results, it is important to note that these require additional modules and development skills. SAC Analytics complements GR effectively and provides an Excel Add-in. However, each client's system landscape varies, necessitating a comprehensive assessment before recommending the appropriate Analytics tool to accompany GR.

Group Reporting vs Analytics