Comparison Group Reporting with BPC and OneStream

Comparison of SAP S/4 HANA Group Reporting, BPC, and OneStream

This topic encompasses complex aspects. It is important to recognize that while SAP S/4 HANA Group Reporting, Business Planning and Consolidation (BPC), and OneStream all fall within the Enterprise Performance Management (EPM) domain, they serve distinct functions. BPC and OneStream primarily focus on analytics and planning, whereas Group Reporting (GR) is an accounting tool designed to ensure accurate categorization, validation, and balancing data from the initial submission by local accountants to the final corporate monthly close with the last group validation. Group Reporting has been developed to satisfy the complex requirements of the corporate monthly close and comply with US GAAP and/or IFRS standards.

Group Reporting is super precise and geared towards providing functionalities that local accountants need to produce a trial balance with data integrity and assist the corporate accounting team in calculating complex eliminations and adjustments. It ensures users do not make contextually incorrect postings or enter erroneous data. Group Reporting excels in precision, making it ideal for accountants who value easy tracking and auditing. It handles complex calculations related to changes in capital structure, mergers and acquisitions, divestitures, step acquisitions, and more. Users provide "control data" in a flat file, and the system automatically posts complex elimination entries, starting with equity against investments and any delta being posted to goodwill.

Unlike Group Reporting, BPC and OneStream require more developer intervention for scripting and involve more manual processes. BPC is favored by finance professionals due to its flexible and user-friendly Excel interface, which allows for easy report creation through drag-and-drop features. It offers high adaptability similar to using a whiteboard where various tasks can be completed with scripting. However, Group Reporting does not offer the Excel-based interface provided by BPC. Instead, it should be viewed as an additional solution, with alternatives such as SAC Analytics, Analysis for Office, or other partner-provided Excel-based interfaces.

Clients should utilize these standard customization options, avoiding the necessity for ABAP or API work, which are considered standard within the framework. For clients implementing S/4 HANA, the integration of master and transactional data, coupled with cost-efficiency, makes Group Reporting a preferred choice, particularly given SAP's favorable package deals. When properly configured and utilized to their full potential, Group Reporting ensures compliance, internal control, and audit readiness, requiring only occasional one-off adjustments.

Notably, Group Reporting pre-delivers all security roles, such as “local accountant” and “corporate accounting manager.” The Data Monitor is developed to enable local accountants to manage the entire process of providing their monthly data. Local accountants run tasks in the Data Monitor for both SAP and non-SAP entities, including loading data with correct trading partners, balancing trial balances, and performing custom validations. Tasks such as “Release Universal Journal” for SAP entities and “Data Collection” for non-SAP entities ensure an equal net income calculation from the Profit & Loss statement to the retained earnings in the balance sheet. Corporate accounting teams monitor progress in the Data Monitor and, upon submission of data by local accountants, streamline the data with currency translation, intercompany eliminations, and automatic consolidation of investments.

Group Reporting also has a pre-delivered solution for eliminating intercompany profit in inventory whereas the other mentioned EPM solutions will have that functionality built from scratch by IT technical support. In summary, Group Reporting and BPC/OneStream are distinct tools with unique functionalities. SAP enthusiasts who appreciate precision and conciseness will find Group Reporting highly satisfactory. Additionally, a robust Excel-based reporting solution can be built upon Group Reporting. SAP is moving towards enabling business users to independently manage their Group Reporting platform without needing extensive IT support. Changes in Master Data, such as the consolidated chart of accounts, organizational hierarchy adjustments, Balance Sheet and P&L hierarchy changes, and Cash Flow adjustments, are all designed for finance professionals to handle directly.

It is worth mentioning that OneStream is gaining popularity among finance professionals for similar reasons as BPC. However, OneStream, like BPC, does not integrate with S/4 HANA, presenting similar challenges. Overall, it represents a mindset adjustment: Group Reporting provides comprehensive control, compliance, and minimized risk through its precise and pre-delivered processes, whereas OneStream, much like BPC, is comparable to a versatile "whiteboard."

OneStream requires significant investment and is complex to implement. Licensing and implementation costs can be substantial. While intuitive for finance teams, the technical aspects may necessitate additional training (e.g., cube design, XF Marketplace). Compared to other CPM tools, OneStream may require extra effort for integration with certain ERP and business applications. It demands a dedicated team for maintenance and optimization. As a newer player, OneStream has fewer experienced professionals and resources available for support compared to established competitors.

SAP Insider LAS VEGAS 2025 – Addressing Clients’ Pain Points in the Corporate Close Process through Group Reporting

The SAP community demonstrated remarkable unity and enthusiasm during the event. The engagement of SAP experts, whether from the client or vendor side, was impressive. The energy and passion of this event continue to resonate.

Consolidation Core established several meaningful connections, enhancing our understanding of solutions and adjacent services. Staying informed about market trends and clients’ needs remains our foremost priority.

We attended all “Group Reporting (GR)” sessions and observed a significant interest among clients in implementing GR shortly. They posed thought-provoking questions, which are summarized below:

1) How can we persuade Finance professionals within our organization to adopt GR and upgrade from BPC?

Clients expressed challenges in convincing their Finance departments to transition from BPC to GR, particularly given Finance directors’, managers’, and analysts’ preference for BPC’s Excel-based interface and ease of report creation and navigation.

2) How can we seamlessly integrate non-SAP subsidiaries into an interconnected S/4 HANA landscape?

Concerns have been raised about integrating non-SAP entities, as not all subsidiaries use SAP systems. Given that SAP promotes its S/4 HANA integration capabilities, clients may assume that integrating non-SAP entities would be challenging. However, GR has pre-delivered capabilities for such integration, considering it is common for organizations to have subsidiaries that are not on SAP or will not be for some time.

3) What functionalities does GR offer regarding the elimination of Intercompany Profit in Inventory?

Clients from various industries (Manufacturing, Pharmaceuticals, Technology and Electronics, Energy and Chemicals, etc.) with complex requirements sought detailed information on GR’s capabilities in eliminating Intercompany Profit in Inventory.

4) What alternatives are available for an Analytics solution to enhance GR?

Another prominent topic was the Analytics solution for GR, as the pre-delivered Fiori reports lack user-friendliness. Fortunately, we identified an exceptional partner specializing in an Excel-based interface compatible with any SAP transaction or Fiori Tile. Please inquire for more details.

We will address these pain points in our upcoming blogs. Stay tuned for further insights!

Is Group Reporting a “Reporting” Tool?

SAP has introduced an intriguing name for its long-standing consolidation engine application: “Group Reporting” (GR). This tool represents the culmination of several evolutionary cycles from its predecessors, including ECCS, SEM-BCS, and BPC. GR incorporates various functionalities, with its core capabilities established decades ago. Notable advancements include seamless integration with S/4 HANA, facilitating shared Master Data and Transactional Data among connected modules. Additionally, the implementation of Fiori reports, which are web-based, along with integration with SAC Analytics and Planning, are noteworthy updates.

So, how do we address whether GR is a reporting tool? The answer is nuanced. GR’s primary mission is to enable, streamline, and automate the monthly corporate close process, ensuring compliance with US GAAP or IFRS. It addresses complexities such as special currency translation for equity and movements for the Cash Flow statement and automates eliminations for AR/AP, Sales, Dividends, and P&L.

A key feature is the automatic consolidation of investments, which allows the system to manage complex ownership structures, calculating minority interest and goodwill. This is especially valuable in industries characterized by dynamic mergers, ownership restructuring, acquisitions, and divestitures, such as Financial Services, Insurance, Technology, Energy, Utilities, Media, and Telecommunications. Automatic calculations enhance data control and integrity significantly.

Other notable features include the Intercompany Matching and Reconciliation Tool (ICMR), enabling real-time reconciliation of AR/AP transactions, and custom validations that focus on data integrity and quality specific to each organization.

It also enables consolidation by profit center, treating each profit center as an individual unit. This approach facilitates segment reporting, which is essential for Financial Planning and Analysis (FP&A). Consolidated actuals by segment serve as the critical starting point for each forecast cycle.

Following the execution of tasks in the Data and Consolidation Monitor—which streamline, translate, unify, validate, and eliminate data—users should ideally obtain perfectly consolidated financial statements, such as the consolidated Balance Sheet and P&L. However, challenges arise with the “out-of-box” reports provided by the Web-based Fiori apps. These reports often require customization to align with the client’s Master Data and suffer from limited formatting options, leading clients to export data to Excel for final adjustments.

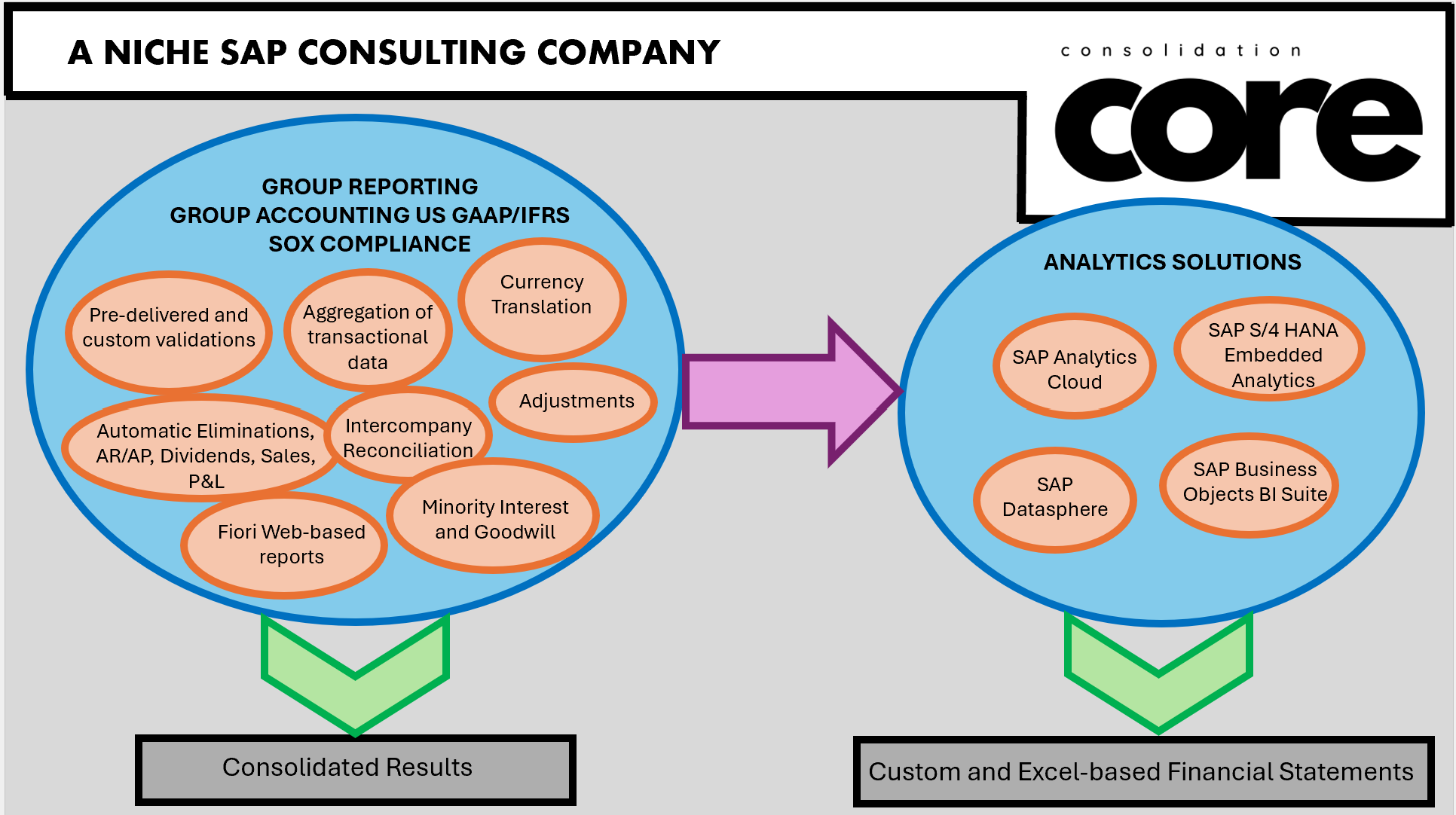

While SAP offers Analytics solutions that complement GR’s consolidated results, it is important to note that these require additional modules and development skills. SAC Analytics complements GR effectively and provides an Excel Add-in. However, each client's system landscape varies, necessitating a comprehensive assessment before recommending the appropriate Analytics tool to accompany GR.

Group Reporting vs Analytics

Cash Flow Statement in Group Reporting

Cash Flow Statement in SAP S/4 HANA Finance for Group Reporting

The Cash Flow Statement is a critical component of each corporate close cycle and holds significant strategic importance for external stakeholders. Ensuring its accuracy is paramount. Certain industries, such as Energy and Utilities (due to infrastructure and equipment complexities), financial services (owing to diverse financial activities), and telecommunications (because of technology upgrades and long-term contracts), particularly face challenges in creating a reliable cash flow statement. However, no organization, regardless of industry, finds it "easy" to prepare an accurate cash flow statement.

Additionally, organizations have multiple workstreams (e.g., Treasury, Capital Structure, Tax) that contribute to the complexity of accurately collecting the data required for the Cash Flow Statement. Consequently, clients are notably enthusiastic about SAP's "out-of-the-box" cash flow statement solution, which can ultimately lead to increased automation, streamlined processes, and enhanced data control and integrity.

While SAP S/4 HANA for Group Reporting (GR) includes a standard Cash Flow report, there are nuances that clients should understand to avoid any unexpected issues. Analytics, including the Cash Flow Statement, are unfortunately often among the last items addressed in a standard project cycle. Maintaining discipline in managing data integrity is crucial, as GR cannot determine allocations for categories (line items, operating, financing, and investing activities) from overall amounts without precise input.

In an optimal SAP ecosystem, local accountants accurately capture movements (such as Balance Sheet movements like changes in PP&E and P&L items like depreciation and amortization) in the general ledger. These movements are then correctly loaded into GR, allowing departments such as Corporate Accounting, Treasury, Capital Structure, Tax, and others to make necessary adjustments directly in GR with a dedicated document type for each workstream. Authorizations ensure that all adjustments are tracked by workstream/user and timestamp.

It is important to note that no two cash flow statements are identical, and each client has unique sets of Info objects and Master Data, often making the pre-delivered standard report obsolete. Furthermore, the "out-of-the-box" Cash Flow Statement advertised by SAP is a web-based Fiori report. Many organizations, including directors and analysts, still rely heavily on Excel-based interfaces for quick calculations and formatting, a critical aspect not sufficiently addressed by standard web-based Fiori reports. Most clients have established formats integrated into their official documentation processes, indicating a preference for custom Excel-based Cash Flow statements, which our company can assist in developing.

GR offers functionalities that can help develop the Cash Flow Statement through “reporting rules” defined by the user. These include a range of mathematical operators to instruct the system on how to compile data for each line item in the Cash Flow Statement. GR's reporting rules provide extensive customization capabilities, including account movements (transaction types), journal entries (document types), consolidation units (company codes), and reverse sign indicators among others.

We are available to assist in identifying and assessing requirements from both functional and technical perspectives. Our goal is to build a Cash Flow Statement that is streamlined, accurate, easy-to-read, and aligned with corporate culture.

Why does SAP S/4 HANA Finance for Group Reporting (GR) need a "release" process when data is real-time?

This topic frequently arises in SAP GR implementation projects. It is often challenging for IT professionals to understand that there remains a "release" task that must be deliberately executed in GR, which releases the data from the general ledger to GR. To their credit, it is counter-intuitive to load data that is live in SAP S/4 HANA, given its notable architectural feature and marketing emphasis on real-time data accessibility. Indeed, the data is live and available in real-time.

Why then does SAP design the data transfer for GR in such a manner?

The intricacies of the corporate close cycle encompass multiple critical functions, addressed effectively through the "Release Universal Journal" task:

· The "release" functionality serves as a critical control mechanism, ensuring that consolidation tasks (validations, translation, eliminations, etc.) can run without interference while generating auto-postings.

· Releasing data establishes an audit trail, which is crucial for compliance and regulatory purposes. It documents when the data was finalized (with a timestamp) and who approved it, ensuring transparency and accountability.

· This process ensures consistency across all local reporting units by guaranteeing that all accountants work with the same dataset.

· It is important to distinguish between a regular chart of accounts in the general ledger and a consolidated chart of accounts in a consolidation system such as GR. A prevalent example are the Cash accounts. In a G/L Chart of accounts, it is common to find hundreds of cash accounts. For consolidation, detailed cash accounts can hinder performance and complicate research. A consolidated chart of accounts usually has only a few cash accounts. The "release" functionality aggregates data in its initial step, initiating the consolidation cycle.

Why Currency Translation Should Be Done in Group Reporting (GR) Instead of the General Ledger

It all begins with an idea.

Often on GR implementation projects, I hear statements like, “We are going to perform the currency translation in the G/L and load group currency directly into GR.”

However, this approach oversimplifies a complex scenario. While experts in corporate accounting recognize the intricacies involved, their insights are frequently overshadowed by IT counterparts who are perceived as the 'experts.'

Here's why currency translation should take place in GR rather than in the G/L:

1) In the G/L, local currency values of transactions are translated at the daily rate. Realized and unrealized foreign exchange (FX) gains and losses result from this translation and are posted in the P&L."

2) US GAAP/IFRS, as well as the statement for CASH FLOW, require a different approach when translating local currency to group currency:

a. Non-Equity Balance Sheet accounts are translated at the end-of-period rate.

b. Equity accounts are composed of the sum of monthly changes, translated at their respective monthly average rates. While we often refer to the equity section as 'historic,' there is no singular 'historical rate' per se. The historical value is the cumulative sum of each month's activity, translated at the monthly average rate for each period. Therefore, the final balance of the equity accounts cannot be recreated using a one-time historical rate.

To balance the Balance Sheet, the difference between the end-of-period rate and the historical value is posted as a currency translation difference to a dedicated Financial Statement Item (account in GR) in the equity section. This amount can vary from month to month, even if there is no new activity in the equity accounts, due to fluctuations in the end-of-period rate.

c. Movements on Balance Sheet accounts – The statement of cash flow requires that movements on balance sheet accounts be translated using the monthly average rate. For assets and liabilities, this results in a currency translation difference because the total balance needs to be translated at the end-of-period rate, while the movements are translated at the monthly average rate. The difference between these two values is posted to a dedicated transaction type (movement type) on the account itself.

d. P&L accounts: All P&L accounts are translated using the monthly average rate. Since this translation method is applied consistently across all P&L accounts, no currency translation differences will be generated.

Also, please see the example below for the correct translation for common stock in the equity section following US GAAP/IFRS.